By

Derek Hamilton

May 08, 2024

Several months ago, we wrote about our conviction that inflation would fall further in 2024, and we highlighted the role that housing inflation might play. Since that time, inflation has been higher than expected, leading to concerns among investors that the improving inflation trend could stall out. While we have noted our concerns about the trajectory of inflation in the long term, we believe the near-term path for inflation will be lower, but that the risk that inflation remains elevated is real.

Keep an eye on services inflation

As we previously noted, housing inflation is one area in which we have high confidence that inflation will decline. While official housing inflation metrics have been sticky, real-time rent indicators continue to suggest that inflation in this category will move lower. However, the most concerning part of recent inflation trends, in our view, resides in core services ex housing, which measures prices for services excluding energy and housing prices.

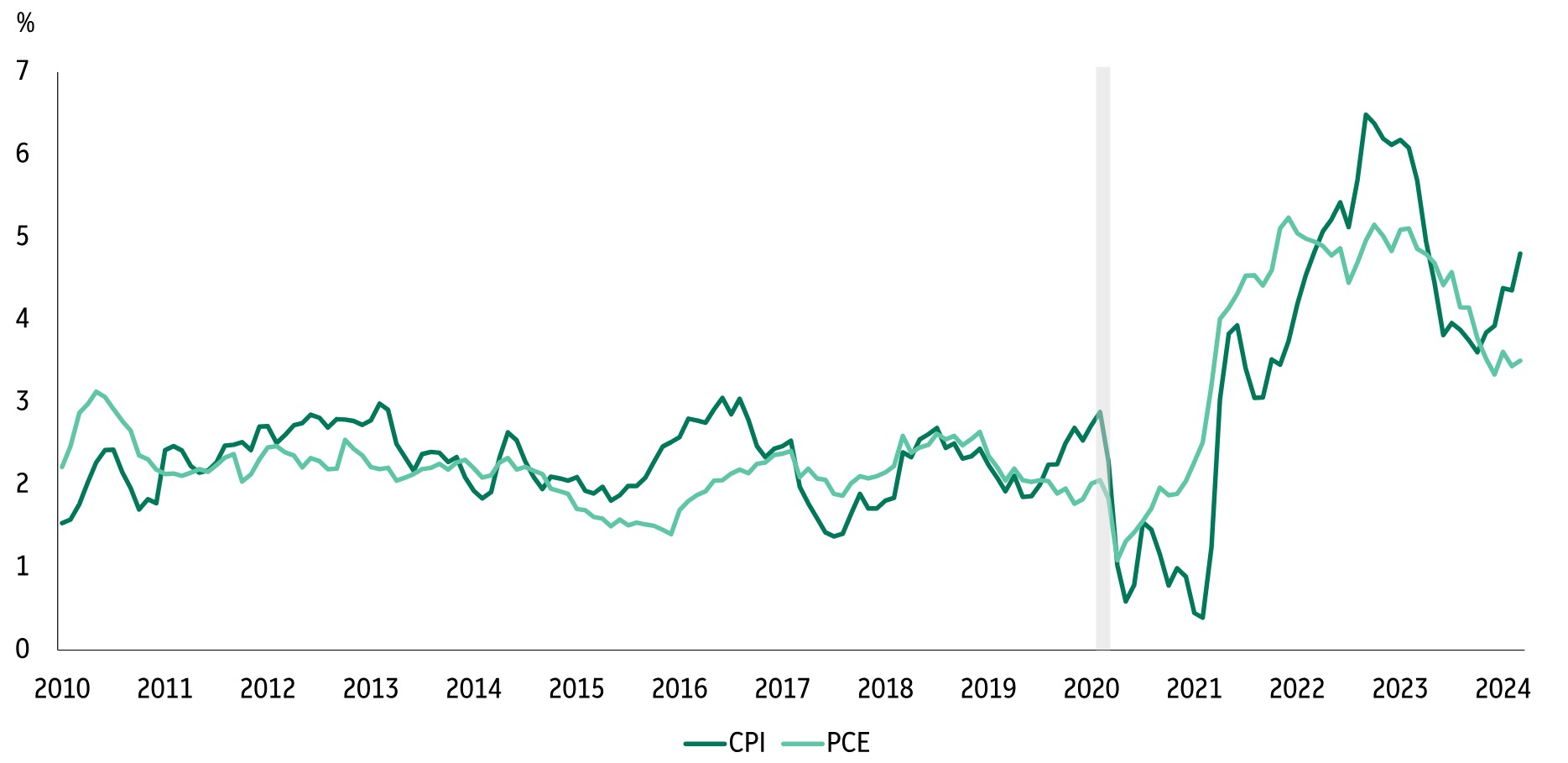

The chart below shows core services ex housing for both the Consumer Price Index (CPI) and Personal Consumption Expenditures Price Index (PCE), the latter measure being favored by the Federal Reserve (Fed) to gauge inflation. While both measures declined throughout much of 2023, that improvement has since stalled. Differences in how prices for certain categories are measured and weighted within each index can result in divergences at times. We believe that idiosyncratic factors have played a role in keeping certain categories’ prices elevated, specifically in healthcare, auto insurance, and financial services. Even so, we believe a lack of further improvement would be concerning because services prices are the most sensitive to wage growth.

How inflation progresses in the coming months, particularly in services, should be the key to whether the Fed reduces interest rates this year.

Core services ex housing inflation

Note: Shaded area on the chart represents a recession.

Sources: Macrobond, US Bureau of Labor Statistics (BLS), US Bureau of Economic Analysis (BEA).

Chart is for illustrative purposes only.

Inside the markets

Chart-powered guide with macroeconomic perspectives and insights on the markets

Access here

[3553312]